Hi, everbody.

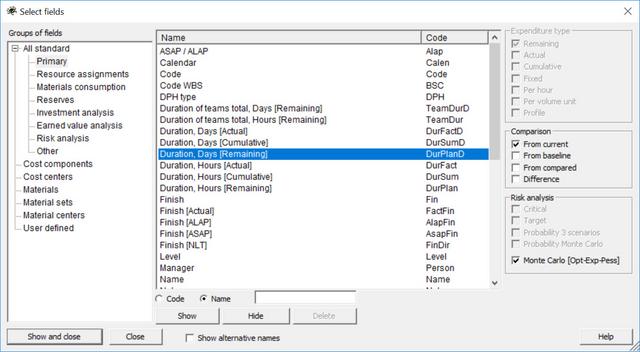

I am just looking at Spiders risk analysis section.

As I understand, the idea is to have 3 schedules: optimistic, expected and pessimistic.

The parctical question is on how to maintail them all 3 in parallel.

I can imagine how I will start it: create Probable schedule, then save it with siffix_pes and and change durations to make it possimicrics and then save with the suffic _opt and make it optimistic.

The question is on how to maintain all 3 schedules going forward:

How to apply progress to al 3 of them?

How to make changes to all 3 of them (e.g. add resource assignment, change dependency)?

What is the expected approach here? Is it really expected, that user would replicate every single schedule update to 3 schedules?

Another questions:

Can optimistic, expected and pessimistic scenarios have different set of activities or list of activities must be the same?

Replies