Driving Project Portfolio Risk & Opportunity Management for Benefit Realization

"Enhance opportunities and reduce threats by aligning sub-portfolios, programs and projects to meet organizational strategic goals"

This article illustrates the high-level components of Portfolio Risk & Opportunity Management. The risk is both threats and opportunity. The main goal is to minimize threats and maximize the opportunities for an organization. Consolidated, organized and well-connected approach is required to manage portfolios, programs, and projects at an enterprise level. Nache and robust system is needed to synchronize all the components of the risk management at corporate level i.e. Enterprise solution. In this era of digitalization where sustainability and profitability are the main concerns for the big organization. Business transformation (Organizational Change) can only be successful if all the components are connected systematically to achieve organizational strategic goals. This article provides headway to design, plan, and implement a Portfolio Risk management system at an enterprise level. This article is applicable to Oil & Gas, Construction, IT, Telecomm. Govt, and Utility sectors etc.! Next article will be based on analyzing the projects and programs within Portfolio to prioritize, select and deploy resources accordingly; 4-D (Dimensional) Portfolio system for Organizational Capacity and Capabilities optimization

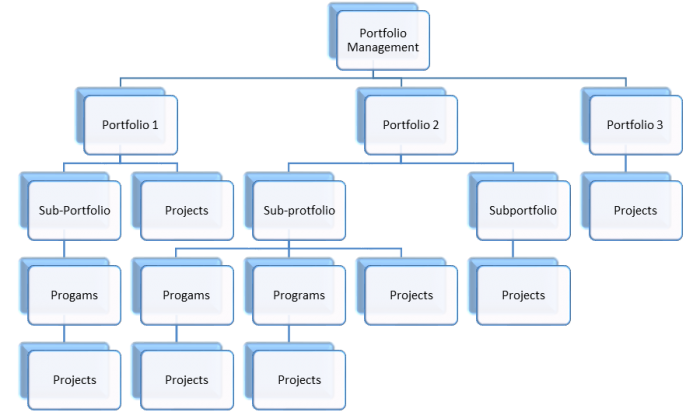

1- What is Portfolio?: A portfolio is, a collection of programs and projects, managed as a group to achieve organizational strategic goals by aligning and optimizing 2P & 2S; People, Process, System, and Structure with the corporate policy and the strategy.

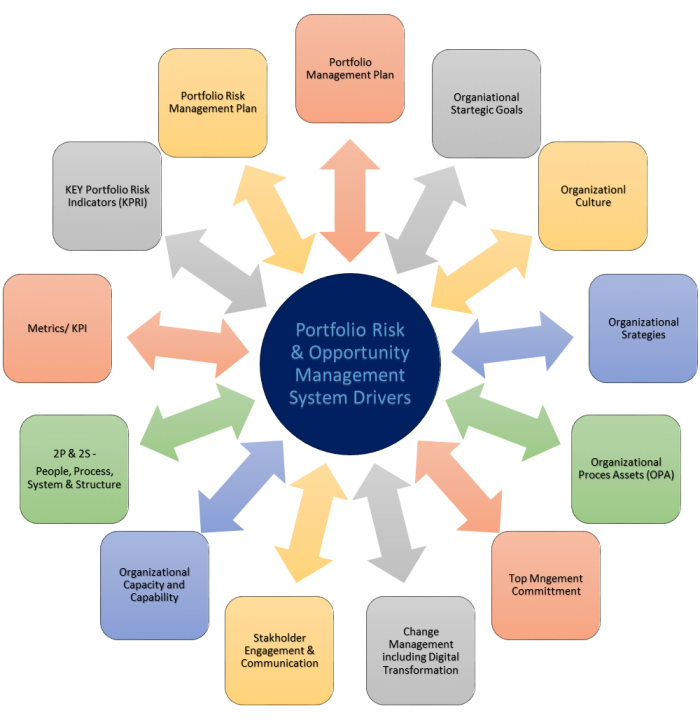

2- Portfolio Risk Management: Planning, designing and implementation of effective Project Portfolio Risk and Opportunity Management system mainly depends on organizational culture, top management commitment to risk management, stakeholders engagement, open and fair communication, processes and business objectives alignment to meet organizational strategic goals. Portfolio dynamics play a pivotal role in shaping up the Portfolio Risk and Opportunity management system. These factors are fiscal boundaries, return on investment, organizational capacity and capability, internal and external forces, change drivers, business transformation dynamics, informational management system, and stakeholder dynamics (especially strategic stakeholders) etc. Portfolio Risk and Opportunity Management is decisively or crucially important for the success of managing portfolios where the cost of portfolio component failure is significant, or when risks of one portfolio component increase the risks in another portfolio component.

Portfolio Risk & Opportunity Management System Drivers

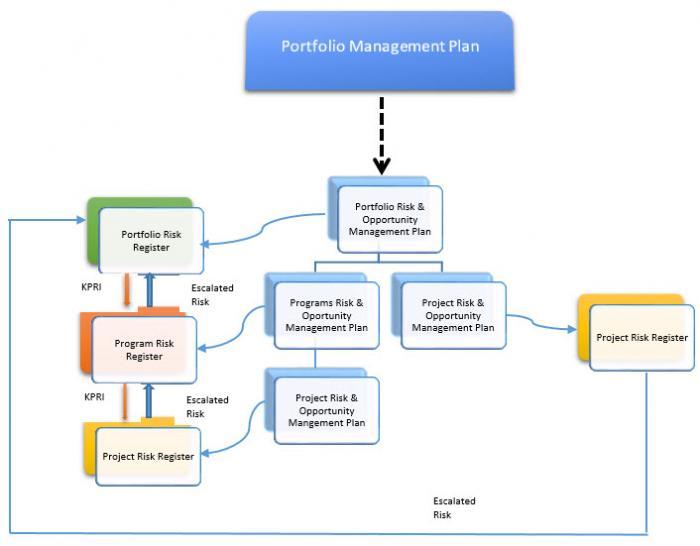

Portfolio Risk and Opportunity management contributes to portfolio component performance that may enhance customer satisfaction, product or service quality and productivity for sub-portfolios leading to substantial profitability and sustainability for an organization. One of the goals of Project Portfolio Risk and Opportunity Management is to aligning sub-portfolios, programs, and projects risks with organizational strategic goals. Portfolio Risk Metrics / Key Performance Indicators (KPIs) help to check and validate the efficacy of the Portfolio Risk and Opportunity Management system i.e. planned vs actual. Successful and conclusive system foundation depends primarily on Portfolio Risk & Opportunity Management plan and Identifying Key Portfolio Risk Indicators (KPRI) at the portfolio level. Driving program and project risk management through Portfolio Risk & Opportunity Management plan and KPRI help to align the complete risk management process to meet organizational strategic goals.

3- Reasons for Portfolio Risk and Opportunity Management Failure: Two (2) cardinal reasons for Portfolio Risk and Opportunity Management failure are:

- In large organizations project portfolio management fails because of managing each sub-portfolios in an isolation. Even the processes are not identical within the same portfolio in different regions or units, resulting in a backlash for an organization to achieve her organizational strategic goals. Therefore, it is required to manage portfolio at the enterprise level by aligning sub-portfolios, programs and projects to overall organizational strategic goals for Benefit Realization i.e. Aligning resources, reduce costs, improve productivity, enhancing customer satisfaction and increase profitability.

- The second main reason of Project Portfolio Management failure is the absence of Portfolio Risk & Opportunity Management system at the portfolio level. Portfolio Risk and Opportunity Management plan gives direction to achieve optimum desired results from the whole risk management process.

Portfolio BreakDown Structure

According to PMI’s Standard for Portfolio Management: “Portfolio Risk is an uncertain event or condition that, if it occurs, has positive or negative effect on one or more project objectives. Risk may have one or more causes and, if it occurs, the corresponding effects may have positive or negative impact on one or more portfolio success criteria.”

4- Portfolio Risk & Opportunity Process Flow: Portfolio Risk and Opportunity Management is a structured process for assessing and analyzing portfolio, programs and projects risks with the goal of maximizing the opportunities and minimizing the threats. Also, mitigating those events, activities, or circumstances which can adversely impact the portfolio is an essential step towards benefit realization. Simple Portfolio Risk and Opportunity process flow is portraying underneath:

Portfolio Risk and Opportunity Process Flow Diagram

5- Portfolio Risk Framework: A well-connected, structured, process driven and stakeholder focused framework should be considered to plan, design and implement Portfolio Risk & Opportunity Management. Each complement of the portfolio, whether there is interdependency or not, must be aligned to achieve overall portfolio management objectives. Integrating risk management to a portfolio level is challenging and require practical insight into how Portfolio Risk Management can be effective for benefits realization and meeting strategic organizational objectives. Risk management maturity across the organization can be achieved gradually by communicating with stakeholders on regular basis. Establish Portfolio Risk Governance framework for better control and direction.

Portfolio Governance Framework

Began the Portfolio Risk & Opportunity Management process by developing Portfolio Risk and Opportunity Management plan followed by conducting a series of Risk workshops, brainstorming session, and interviews with top management and managers at department level including Portfolio, Program and Project Managers to collect the initial inventory of risks. Each of these risks club together to make a list of ten (10) to fifteen (15) risks, Key Portfolio Risk Indicator (KPRI), that may hamper the portfolio objectives. Assign the departmental head of specific department as a Risk owner. Cluster identified Program and Project Risks around KPRI for better monitoring and control. It helps to enhance the opportunities and reduce the threats in meeting organizational strategic goals.

Printer-friendly version

Printer-friendly version- Login or register to post comments

Send to friend

Send to friend